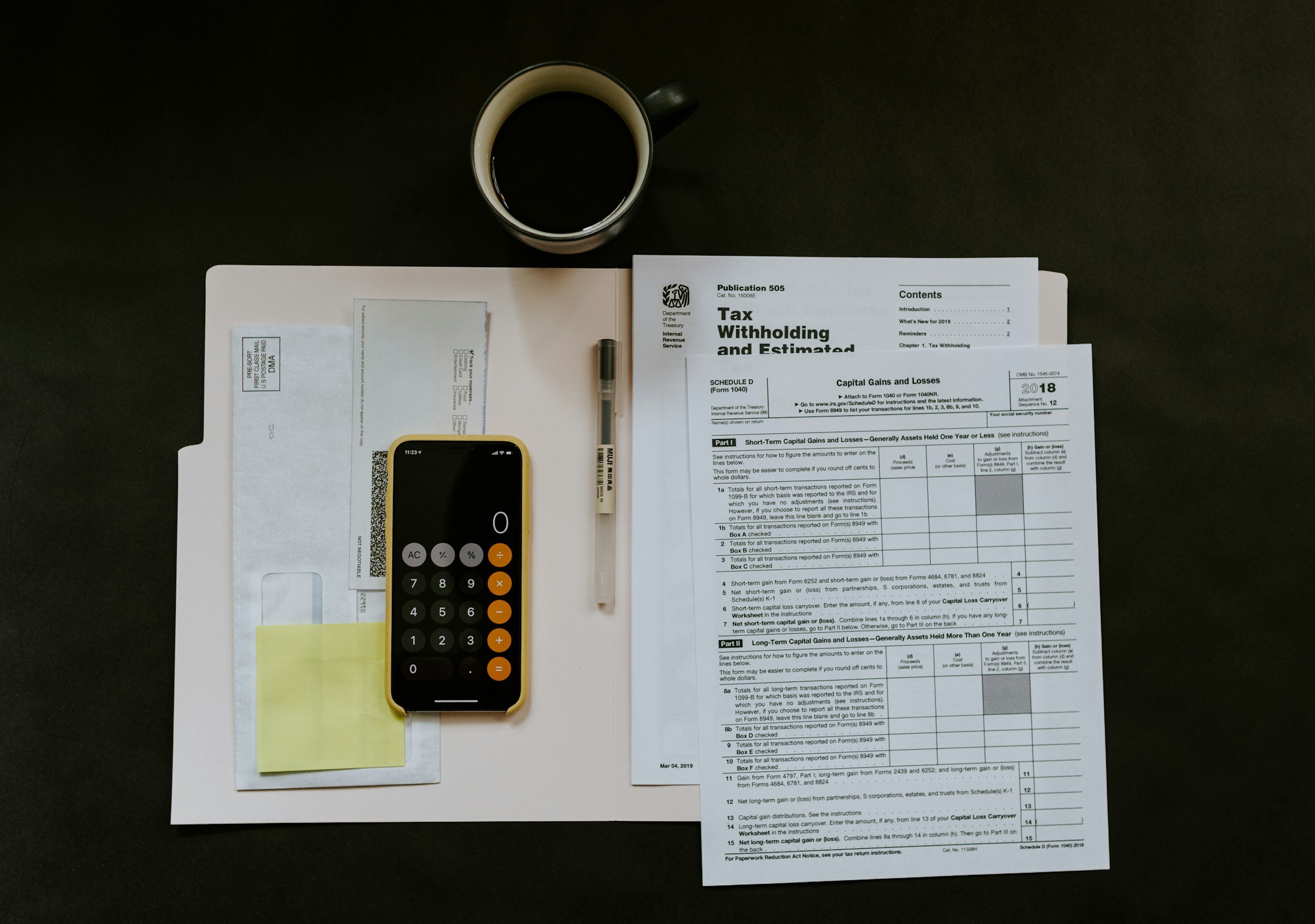

We offer expert tax preparation services to help individuals maximize their refunds while ensuring compliance with all tax laws. Whether you're filing a simple return or need help with more complex tax situations, we provide tailored services to meet your unique needs.

Key Features:

Personal tax return filing (Form 1040)

Tax planning and advice

Maximizing deductions and credits

E-filing for fast processing

Year-round tax support

Our small business tax services are designed to help entrepreneurs and owners navigate the complexities of business taxes. We assist with preparing tax returns for sole proprietors, partnerships, LLCs, and S Corporations. Let us handle your business taxes so you can focus on growth.

Key Features:

Business income and expense reporting

Filing for various business structures (LLC, S Corp.)

Deductions and credits tailored to your business

Quarterly estimated tax calculations

Tax-saving strategies for small businesses

Missed filing in previous years? Don’t worry! We specialize in prior year tax filings, ensuring you stay compliant and avoid penalties. We’ll help you gather necessary documents, prepare accurate returns, and file them for past years with ease.

Key Features:

File tax returns for previous years

Minimize penalties and interest

Retrieve IRS transcripts if needed

Clarify and resolve issues with past filings

If you need to correct a mistake or missed deductions from a prior tax year, we offer amended tax return services. Whether you’ve received a corrected form (1099, W-2, etc.) or need to update your filing, we’ll guide you through the process of filing an amendment.

Key Features:

Correcting errors on filed returns

Maximizing missed deductions or credits

Help with IRS notices or audits

Filing Form 1040X for amendments

Guidance on refund claims